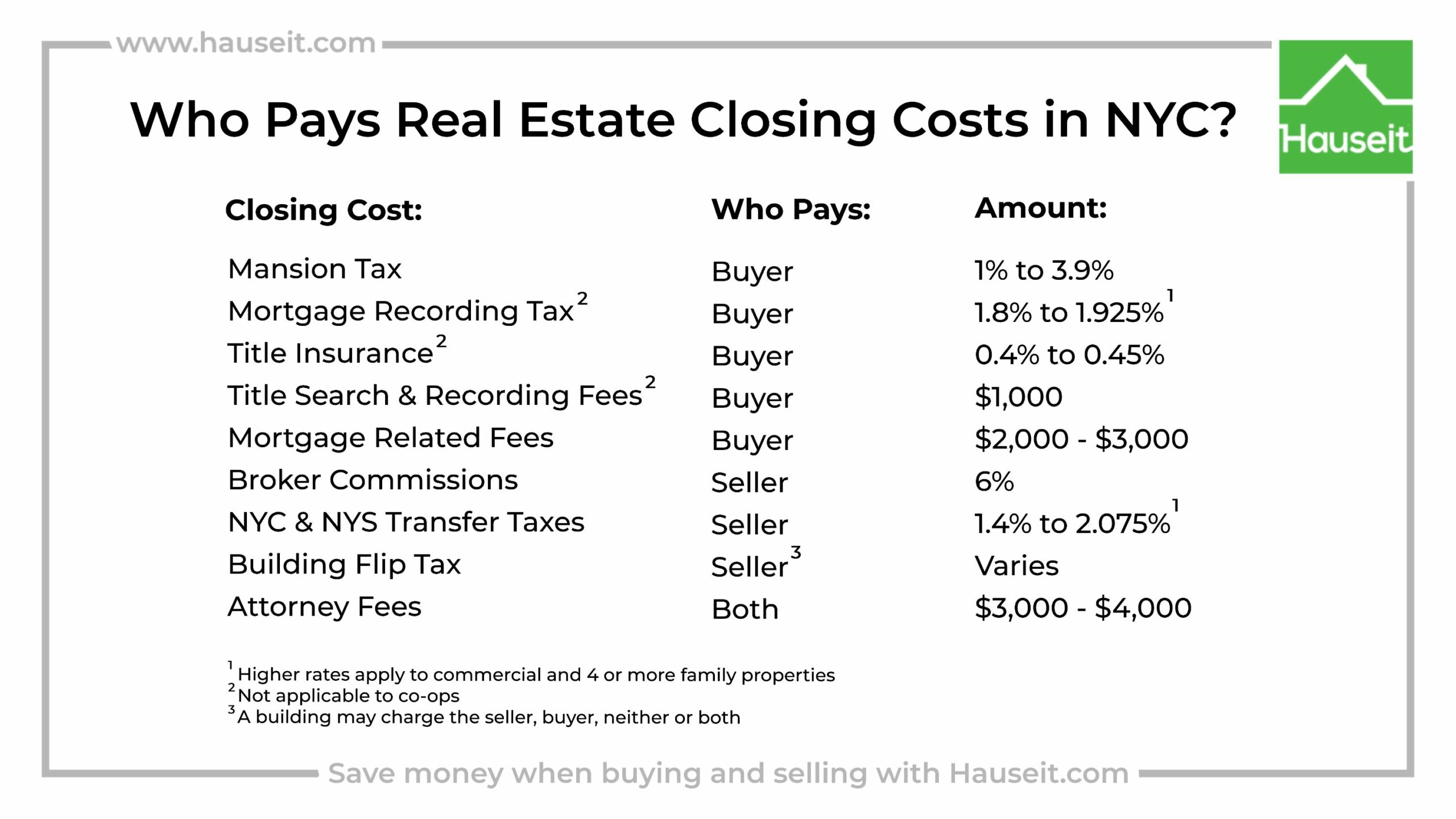

Both buyer and seller are responsible for certain closing costs on a New York City real estate transaction. Neither party absorbs all closing costs, but sellers generally pay the most in closing costs since they customarily pay a 6% broker commission.

Most closing costs on a NYC real estate transaction default to buyer or seller. Except for new construction, closing costs are rarely negotiated in a NYC real estate transaction.

Buyers in NYC typically pay the following closing costs:

-

Mansion Tax: 1% to 3.9%

-

Mortgage Recording Tax: 1.8% to 1.925%

-

Title insurance: 0.4% to 0.45%

-

Mortgage related fees

-

Buyer’s attorney fee

Total buyer closing costs in NYC are between 1.5% to 6% of the purchase price. The easiest way to lower your closing costs when buying in NYC is to request a commission rebate.

Sellers in NYC typically pay the following closing costs:

-

Broker commissions (including the buyer agent fee): 6%

-

NYC & NYS Transfer Taxes: 1.4% to 2.075%

-

Building flip tax (if applicable)

-

Seller’s attorney fee

-

Loan payoff fees

Seller closing costs in New York City are between 8% to 10% of the sale price. The vast majority of this amount consists of broker commissions. Fortunately, there are ways to sell in NYC without paying 6%. Lower cost options include 1% Full Service or Agent Assisted FSBO.

In the case of new developments, closing costs are frequently negotiated between the buyer and developer. However, don’t expect to pay lower closing costs on a new development simply because they’re negotiable.

The negotiability of closing costs for new developments stems from the fact that buyer closing costs on new developments are higher to begin with.

Additional buyer closing costs associated with new developments include NYC & NYS Transfer Taxes, sponsor attorney fees, working capital contribution and resident manager’s contribution in the case of larger buildings.

Negotiability varies by new development. If a developer is particularly motivated, they may even agree to cover additional closing costs beyond transfer taxes and sponsor legal fees.

In one notable instance, we negotiated with a particularly motivated sponsor who agreed to cover numerous closing costs and throw in several freebies:

-

NYC & NYS Transfer Tax

-

Mansion Tax

-

Resident manager’s contribution

-

Working capital contribution

-

Sponsor’s attorney fee

-

Free parking spot

-

Free storage unit

-

Sponsor will pay property taxes and common charges for 6 months

-

Sponsor will run a gas line to the outdoor terrace

-

Sponsor will soundproof the easterly wall in the master bedroom