NYC vs. London - Real Estate Commissions

Are you looking to sell your NYC apartment and find yourself asking why New York City real estate commissions are so high?

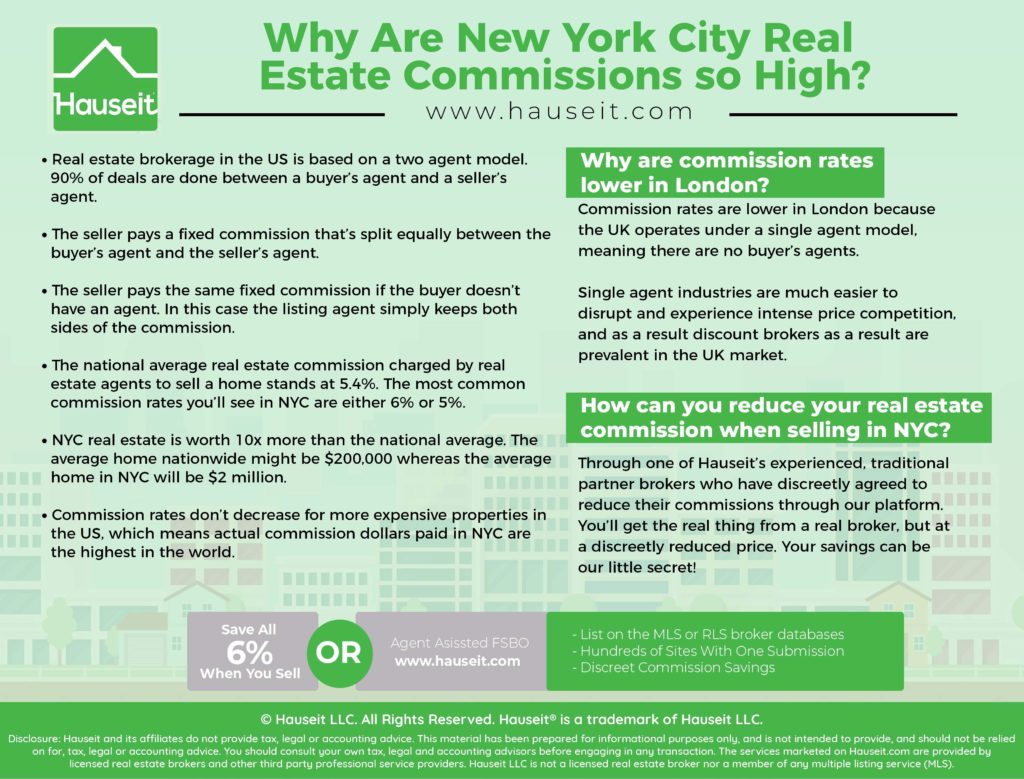

You’ll likely be both surprised and disappointed to learn that New York City is home to the highest residential real estate commission rates in the world:

Both compared to commissions charged in other comparable countries and compared to commissions charged in the rest of the USA.

Since you may be in the process of considering your options as a home seller in New York City, it is helpful to know exactly why NYC real estate commissions are so high compared to cities like London, and what you can do about it to save your home equity and avoid paying 6% in NYC real estate commissions.

New York City has the highest average real estate commission rate in the developed world and in the United States.

According to the New York Times and the Economist, the national average real estate commission charged by real estate agents to sell a home stands at 5.4%.

To put that in perspective, in the United Kingdom, the going rate for full-service real estate representation by an agent is less than half of what it is in the USA.

Home sellers in London pay roughly 1.7% in real estate commissions for the services of a full-service listing agent while NYC home owners pay on average 6% in total real estate commissions.

Based on the NYC median sale price of $1.7 million, home sellers in NYC pay an extra $73,100 in real estate commissions compared to home owners in London.

Furthermore, while in London and the UK it’s common place for real estate agents to actually charge a lower commission for more expensive properties, there appears to be virtually none of this behavior by traditional full-service listing agents in NYC.

What this means is that in London, the average real estate commission is lower than what it is in other parts of the UK.

This makes sense intuitively because London real estate is renowned as a globally safe and in-demand asset class. If something is easier to sell, then the cost of buying and selling it should be lower! Surely it’s harder to sell a farm in Southern England that it is to sell an apartment in central Mayfair! It is reasonable that real estate agent commission rates in London are lower than those charged in Tier 2 and Tier 3 UK cities.

The same logic should apply to NYC real estate. It’s an asset class with global demand. Therefore, commission rates to buy and sell NYC real estate should be in line with the difficulty of selling, which is not difficult at all when everyone in the world wants a piece of the NYC action. As was the case for London vs. the rest of the country, NYC real estate commission rates should be lower than those charged in a small rural city in America. It’s precisely in those parts of the country where the real estate agent has to work the hardest to find a buyer!

As it turns out, NYC real estate commissions are actually higher than what is charged in most other parts of the country. When you combine the highest percentage real estate commission in the country with one of the highest media sale prices in the United States (over $1.7 million), you can start to see why it pays to be a traditional full service listing agent in NYC! The average NYC commission check is over $100,000 per deal.

New York City should have some of the lowest real estate commission rates in the world. Here’s why:

As we like to say, NYC home sellers can easily sell their condo/coop For Sale by Owner without paying any NYC listing agent commission in today’s market. New York City is one of the easiest places in the country for home owners to sell FSBO without a broker and achieve success. NYC is also one of the easiest places for full-service listing agents to find buyers!

Here’s why it’s so easy to sell FSBO in NYC:

-

NYC FSBO sellers own property in a city which has one of the largest and most diversified economies in the world

-

NYC FSBO sellers own property surrounded by the best subway system in the USA, meaning it’s absurdly easy to both show and view property for sale

-

NYC FSBO sellers own apartments in a city which is one of the greatest intellectual and cultural melting pots in the world

-

NYC FSBO sellers own property in a city that’s a global icon which attracts millions of tourists per year

-

NYC FSBO sellers live in the city that never sleeps

What does this have to do with real estate? And selling a property FSBO?

-

NYC real estate is among the most sought after, safe and secure real estate in the world – just like in London and Hong Kong

-

NYC real estate will always be in-demand, even in another Great Depression

-

NYC is the first real estate market where prices go up in a Bull market

-

NYC is the last real estate market where prices go down in a Bear market

NYC Real Estate Sells Itself. Real Estate commissions in NYC should be extremely low because it’s very easy to sell property in NYC compared to virtually all other cities in the world.

Factors which make it hard to sell in other cities, such as poor transportation, a weak economy, or lower incomes, are not present in the NYC market.

What’s funny is how NYC real estate agents get away with charging some of the highest commission rates in the country and worldwide when the property they are listing is some of the easiest to sell!

NYC FSBO sellers have every element stacked in their favor to maximize the chances of finding a buyer without having to use a listing agent.

Types of Full-Service Real Estate Representation in London vs. New York City:

The United Kingdom does not have the traditional ‘listing agent’ and ‘buyers agent’ like we have in the United States.

Instead, UK sellers who are considering working with a full-service real estate agent must choose between the following options:

Sole Agent

Having a Sole Agent represent you in the UK means that you will have just one agent acting on your behalf who will earn 100% of the commission being offered alongside your property. Because the likelihood of the agent earning your commission is higher (since there are no other agents in play), the real estate commissions charged are generally lower and in the range of 1% to 1.5%. Having a sole agent also means that you are not able to transact through a buyer represented by another agent. The concept of “co-broking” which is so strong in New York City (splitting the 6% commission between listing agent and buyers’ agent) does not exist in the UK under the sole agent listing agreement.

Joint Sole Agent

The Joint Sole Agent structure in the UK is the closest thing to the traditional NYC listing agent under an Exclusive Right to Sell Listing Agreement with co-broking. Under the Joint Sole Agent arrangement, the seller hires two listing agents and agrees to split the commission equally between them. The idea behind this structure is to hire two agents who traffic in different buyers’ circles and have differing marketing strategies. With this setup, unlike the NYC Exclusive Right to Sell listing arrangement, if a buyer is found by either agent the commissions are split equally between both agents no matter what. NYC Listing Agents under an Exclusive Right to Sell agreement do not split the commission with buyers’ agent if the buyer was procured by the listing agent.

Multiple Agents

A Multiple Agency Arrangement in the UK is just like a NYC Exclusive Right to Sell listing agreement with one minor difference: instead of there being a listing agent and a TBD buyer’s agent (if buyer is not found directly by the listing agent), there are 3 predetermined agents. Only the agent who finds the buyers gets paid any commission. Under this arrangement, all three agents are fiercely competitive with one another since it’s an all-or-none situation with regards to earning the real estate listing agent commission. The typical real estate commission under a multiple agency arrangement setup is 2.5%-3% of the sale price.

Full-Service Listing Agreements in London vs. NYC Listing Agreements:

Sole Selling Rights

This type of UK listing agreement binds the seller to pay the listing agent a commission even if the seller finds the buyer on his or her own. In that sense, it’s very similar to the commonplace NYC Exclusive Right to Sell listing agreement. A key difference between this agreement and the NYC Exclusive Right to Sell is that no other agents are allowed to sell your home. UK listing agents who have “Sole Selling Rights” keep the entire commission and have no obligation to share it with a buyers agent.

Multi Agency

This type of agreement is used for ‘multiple agency arrangements’, whereby a UK home seller offers to pay one commission to whichever of the agents finds the buyer. This is comparable to a New York City ‘open listing‘.

Ready, Willing & Able vs. Sole Agency

For either a “Sole Selling Rights” or “Multi Agency” listing agreement, the document can be either a “ready, willing and able purchaser” or “sole agency” subtype. In the case of the former, this obligates the seller to pay a commission to the real estate agent who finds a buyer even if the seller decides not to go through with the sale. In the case of “sole agency”, the seller is permitted to procure a buyer on his/her own without being obligated to pay a commission to the agent.

Quirks of London Real Estate Agents vs. NYC Real Estate Agents:

Sliding Scales

It’s not uncommon in the UK and London for the real estate agent percentage commission rates to be on a sliding scale based on the sale price. If the property sells for a higher amount, then the commission rate steps up in bands. Conversely, if the property sells for a price on the lower end, then the real estate commission rate would bracket down. This is not common in NYC, however we think it’s actually a great idea because it incentivizes listing agents to maximize proceeds for the seller.

The real problem with NYC full-service listing agents is that they have no real incentive to sell your home at the best possible price. NYC agents with 6% Exclusive Right to Sell listing agreements would prefer a quicker sale at $1.5 million to a sale at $1.55 million which takes 3 months longer.

Why? Simply put, the agent prefers to get paid 6% ASAP on $1.5 million (earning $90,000) than spending an extra 3 months and risking the expiration of the listing agreement just to earn an extra $3,000 in commission for himself or herself.

Commission based on Asking Price

Believe it or not, in the UK some real estate agents attempt to charge a commission based on the asking price instead of the listing price. This nifty little trick is definitely not something we’ve heard of in NYC or ever want to see!

Sales Tax

Commission rates in the UK may be quoted either inclusive or exclusive of VAT (value added tax, or the rough equivalent of sales tax in the UK). Since the current rate of VAT in the UK is 20%, it’s critical for UK home sellers to know how their commission rate is being quoted. Otherwise, 1% could turn into 1.2% and 2% could turn into 2.4%, etc.!

Why are Real Estate Commissions lower in London than in New York City?

No MLS / Commission Splitting

Since the custom in the UK is to have one agent represent both buyer and seller, there is no commission splitting. If only one agent needs to be paid for each transaction, then it somewhat makes sense why commission rates in the UK are roughly half of those which are charged in the US, where both listing agent and buyers’ agent split the commission. However, the quirk here is that under a NYC ‘Exclusive Right to Sell’ listing agreement, the listing agent has the potential to earn the entire 6% commission if he/she finds a buyer or if the owner finds the property by himself or herself. The opportunity to earn such a huge real estate commission on a residential property deal does not exist in London or the United Kingdom.

How can you reduce your real estate commission when selling a condo or coop in NYC?

If you are too busy to sell FSBO, save with our discount 1% full-service listing option:

For the busy home sellers of NYC, having a full-service listing agent does come with substantial advantages. But no amount of convenience can justify paying 6% in agent commissions. For that reason, Hauseit offers a discount 1% full-service offering for busy NYC home sellers who want to sell FSBO and save but are short on time. It’s an identical service to what a full-service listing agent offers but for a fraction of the commission.

The savings you pocket by paying just 1% for a full-service listing agent can help you significantly reduce your NYC closing costs.

Compared to selling for sale by owner in NYC, you also benefit by saving a substantial amount of time and reducing stress.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

If you have time, sell FSBO in NYC and save the full 6% in agent commissions:

Every week we see more and more NYC sellers (who were considering paying 6% in agent commissions but just didn’t feel right about it) calling Hauseit and asking how to list FSBO in NYC. Hauseit offers all of the individual tools NYC FSBO sellers need to find a buyer in New York City.

It really works. Before you sign away 6% (in NYC that’s over $100,000) consider giving Hauseit a call or by visiting Hauseit’s FSBO NYC headquarters to learn how to save that commission and put it to better use.

With that said, the NYC FSBO process is not as easy as hitting a sell on a stock in your Etrade portfolio. You need to learn how the FSBO market works in NYC.

If you don’t, you run the risk of drawing the ire of the city’s real estate agents and becoming a target – in a bad way.

Before going on the market, NYC FSBO sellers need to understand things like how to cobroke FSBO in your local interbroker database. To begin the NYC FSBO listing process, please submit your listing information online.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.